Developing countries need trillions for climate action. Where will it come from?

In 2009, when representatives from around the world gathered in Copenhagen, Denmark to discuss global action on climate change, wealthy countries pledged $100 billion a year to help developing nations adapt to the impacts of rising temperatures and curb carbon emissions.

The number was arbitrary, tossed into the fray by then-Secretary of State Hillary Clinton as tensions rose over rich countries’ responsibility to pay for the problem they had largely caused. But it stuck, and 2020 was set as a goal for delivering the funds.

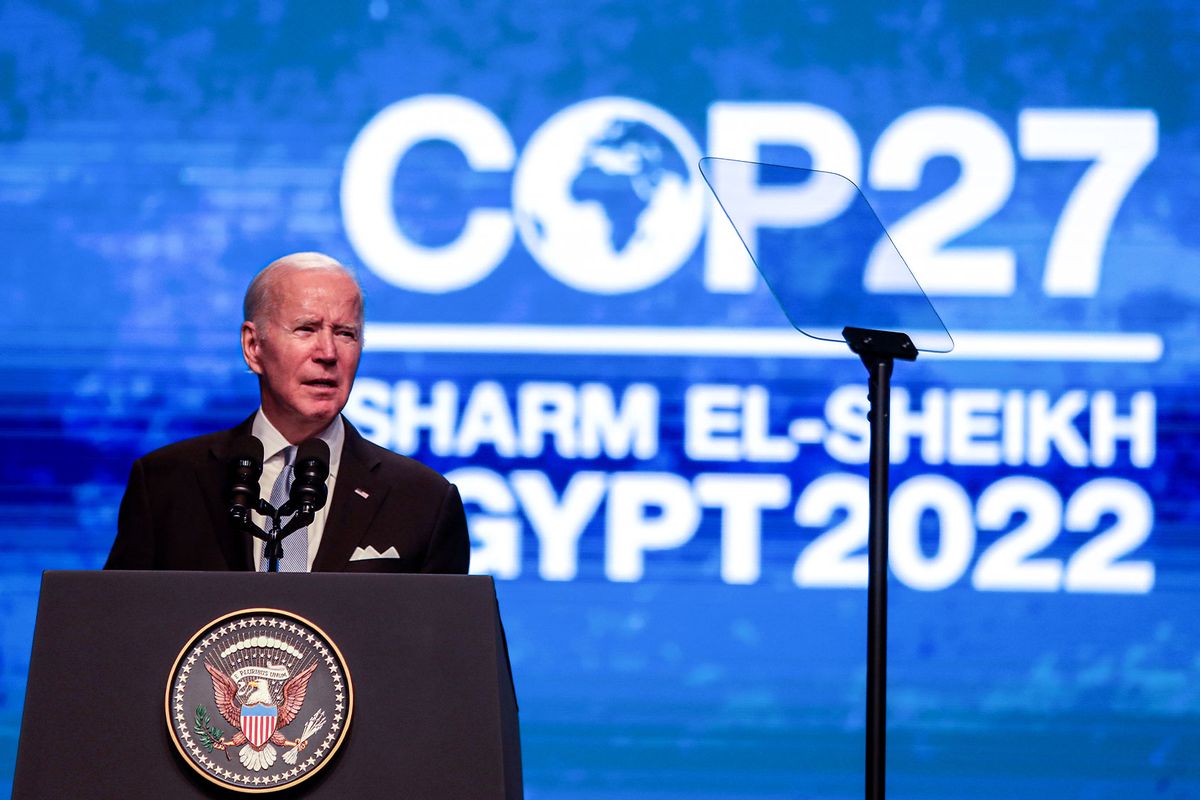

This month, at the United Nations climate conference in Sharm el-Sheikh, Egypt, or COP27, these payments were once again front and center. Wealthy nations have yet to meet their $100 billion a year promise, the costs of mitigating and adapting to climate change are only growing, and developing nations are also calling for reparations for the impacts they are already suffering.

A report released last week found developing countries, excluding China, will need $2 trillion a year to deal with the worsening impacts of global warming and transition their economies away from fossil fuels. Half of that money “can be reasonably expected” to come from domestic sources, the report said, but international finance — from wealthy countries to the World Bank — must make up the rest.

How that money will be raised and provided to developing nations was a focus of negotiations in Egypt. Everything is on the table.

“Over the last few months, the role of different institutions has come to the fore,” said Preety Bhandari, a senior advisor in global climate and finance at the World Resources Institute.

Here is an overview of the major strategies being discussed to pay for the mounting costs of climate change:

Unlocking Private Sector Finance

Historically, the bulk of the money for climate finance has come from the public sector — national coffers as well as multilateral development banks and and international finance institutions like the World Bank and the International Monetary Fund, or IMF. But with the costs of climate adaptation and mitigation rising, officials say there is simply not enough money in the public sector to meet climate finance goals for developing countries.

“There is only one place you find the money we need in the trillions of dollars,” U.S. climate envoy John Kerry said in an interview with the Financial Times in May. “That’s the private sector.”

So far, however, it has been hard to get the private sector, which favors investment in high-income countries, to fund projects in the countries that need it most. One report from a climate finance group found that the amount of private capital provided for public-private climate partnerships is actually shrinking. “Every public dollar spent is now mobilizing less than a quarter of private investment,” said Patrick Bigger, research director at the Climate and Community Project.

Last year, several wealthy governments joined forces with investment banks to launch a Just Energy Transition Partnership, or JETP, with South Africa to help the developing nation phase off coal; money has been slow to materialize and the program is expecting a $39 billion shortfall over the next five years. At COP27, another partnership was announced with Indonesia, one of the world’s top exporters of coal, and more are in the works with India, Vietnam, and Senegal.

Calls to increase funding through such “blended finance” strategies are ongoing, but some countries, like Vietnam, have rejected initial JETP packages because they’re primarily composed of loans instead of grants, which do not come from the private sector. John Kerry’s proposal to shore up private investment in JETPs through carbon credits was met with pushback. And developing countries have been wary about relying too much on the private sector to meet the $100 billion goal, saying that rich countries are dodging their own responsibility to pay.

Of particular concern is relying on the private sector to fund adaptation projects. A restored mangrove swamp or an early storm warning system, for instance, doesn’t generate the financial returns that a solar farm does. Over two-thirds of the money raised toward the $100 billion goal to date has been for climate change mitigation. Developing countries are now asking for a more even split, with half of all climate finance flowing to adaptation. Last year in Glasgow, countries committed to double adaptation funding to $40 billion per year by 2025. The discussions in Egypt made little progress towards meeting and expanding that goal.

More Payouts from Multilateral Development Banks

Calls for the World Bank and other multilateral development banks to open their coffers continue to grow louder. These banks, public institutions established with the goal of rebuilding war-torn nations after WWII, have massive sums of money at their disposal, but they are conservative and slow to spend it. Experts say they are over-concerned with their credit rating and too hesitant to take on financial risk.

Barbados Prime Minister Mia Mottley has called for a reform of international finance institutions in her Bridgetown Agenda, a proposal to change the global financial architecture to support climate action and sustainable development. The plan has got a lot of traction at COP27. It calls on the IMF to, among other things, issue $1 trillion in low-interest, long-term loans to climate-vulnerable countries and simplify fast access to funding. It also proposes a climate mitigation trust that would release $650 billion in special drawing rights, credits that can be exchanged for currency and don’t need to be paid back, or that can be borrowed from other countries at low interest rates.

The call to overhaul international finance institutions found support in the U.S. and Germany; French President Emmanuel Macron agreed to suggest changes with Mottley at the next meetings of the IMF and World Bank governors. The COP27 agreement cover text included language on multilateral development bank reform, encouraging the banks to do more with their capital and calling on shareholders to move this along.

Beyond low-interest lending, developing countries are also asking for more grants from wealthy nations and multilateral development banks. Over 70 percent of climate funding for developing nations has been doled out in the form of loans, which add to already exorbitantly high debt burdens.

Addressing the Debt Crisis

Because of the legacies of colonialism and slavery that funneled labor and resources away from the Global South, many developing countries have had to borrow money to meet basic needs. At the same time, these countries are perceived as riskier investments and have had to pay higher premiums and interest rates than rich countries. Current inflation is only making the whole situation worse. Two-thirds of low-income countries are at high risk of debt distress, and this crisis has made it harder for them to prioritize spending on climate change.

“As we run into this economic climate, it’s very easy to go the austerity route,” said Sara Jane Ahmed, financial advisor for the V20, a group of finance ministers from 58 of the countries most vulnerable to climate change. “It’s so important — given the need to invest now and adapt and build resilient economies and communities — that we not go that route.”

The section on finance in the COP27 pact acknowledges the increased indebtedness of developing countries but, beyond calling on multilateral development banks to scale-up grants and “non-debt instruments,” it doesn’t put forward concrete options to address the debt crisis. Other solutions circling around include debt restructuring at lower interest rates, suspension of loan payments after natural disasters, debt-for-nature swaps, and outright debt cancellation, which public figures in Pakistan have called for after crippling debt restricted the country’s ability to respond to devastating floods this year.

The Nature Conservancy has orchestrated swaps in places like the Seychelles, Belize, and Barbados, where countries’ debt is refinanced at a lower interest rate and in exchange, the money saved goes to conservation. But as Kevin Bender, who runs these programs in African and Indian Ocean nations notes, it has been hard to get investors on board.

“Some sort of debt restructure is an inevitability,” said Bigger, who co-authored a report with Olúfẹ́mi O. Táíwò on how debt restructuring and cancellation could be a first step toward climate reparations for climate-vulnerable countries. “The question is will there be a concerted push to do it well now, or will it be done through piecemeal initiatives like you had across the 80s and 90s until you get to ‘Heavily Indebted Poor Countries Initiative’?”

That program, which cleared IMF and World Bank debt for the poorest countries, showed that with enough political will, debt cancellation is possible.

Loss and Damage

A concept known as “loss and damage” became a major driver of discussions at this year’s COP. Separate from but related to adaptation, loss and damage refers to the destruction already being caused by climate change, and the future loss that will be inevitable. Funding for loss and damage has also been referred to as climate reparations.

Developing countries have been calling for loss and damage funding for years. They bear the brunt of climate impacts despite contributing the least to global warming. In Egypt, these nations placed loss and damage on the agenda for the first time and demanded that industrialized countries commit to a dedicated funding mechanism for it, separate from adaptation.

In the second week of the conference, a group of some of the most industrialized countries, led by Germany, proposed a program called the Global Shield, which would include insurance, social security, and other financial assistance that could be deployed when disaster strikes. But loss and damage advocates pushed back against the proposal on grounds that it is unfair to have people in developing countries pay for insurance, that it detracts from the call for a separate direct funding mechanism, and that payouts for similar schemes have been delayed, withheld, or insufficient.

Discussions hit a breaking point over loss and damage, going into overtime on the issue. On Friday morning, the E.U. surprised negotiators by agreeing to a new fund, and the U.S., after years of obstructing this issue, was forced to follow suit. At stake now is how much money will go into the fund and where it will come from. These details will be worked out over the coming year, but there have been some suggestions of additional sources, including taxes on oil and gas profits or on airlines, frequent fliers, and shipping companies. Developing nations have also been adamant that funding for loss and damage be grant-based. While the U.S. has resisted taking on liability for loss and damage, the idea of taxing private companies was received with openness by John Kerry.

There is also the question of whether countries like China, Saudi Arabia, and Singapore, who were categorized as developing countries when the terms were first defined in 1992 but are now some of the world’s leading economies, will be on the hook to contribute to the fund. China has said it would be willing to contribute on a voluntary basis.

Despite the urgency of the climate crisis, final decisions and commitments on how much additional money is needed and where it all will come from are still a few years away. Bodies like the IMF and World Bank that decide things like debt forgiveness and special drawing rights operate outside of the UN climate convention, but “this COP can send a signal for changes that will happen over the next few years,” said Bhandari.

This story has been updated to reflect the final outcomes of COP27.