H1’22: Forex transactions in I & E rises 95% to $20.2bn

…External reserves fall 3.3% to N39.15bn

….Concerns as Naira depreciates by 2.8%

By Babajide Komolafe, Economy Editor & Elizabeth Adegbesan

The volume of dollars traded (turnover) in the official foreign exchange market, also known as the Investors and Exporters (I&E) window rose by 95 per cent, year-on-year (YoY) to $20.23 billion in the first half of the year (H1’22) from $10.34 billion in H1’21.

However, Vanguard analysis of transactions in the window as published by FMDQ showed that on a quarterly basis, turnover fell by 30 per cent to $8.33 billion in the second quarter of 2022 (Q2’22) from $11.9 billion in the first quarter of 2022 (Q1’22).

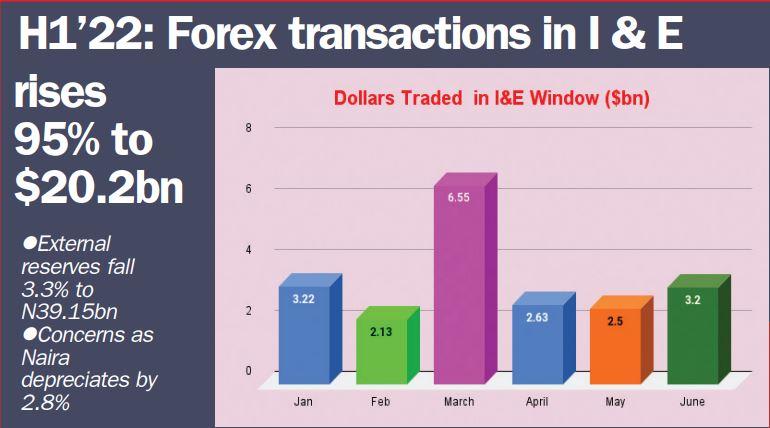

On a month-on-month basis, the trading volume shows consistent fluctuation through the entire half year, 2022.

Turnover stood at $3.22 billion in January but fell by 33.8 per cent to $2.13 billion in February.

In March, it rose by 207 per cent to $6.55 billion, only to fall again by 59 per cent to $2.63 billion in April. This trend continued in May, when turnover fell by 4.9 per cent to $2.5 billion. The trend was reversed in June as turnover rose 28 per cent to $3.2 billion.

External reserves falls

Meanwhile, the nation’s external reserves fell by 3.3 per cent to $39.155 billion on June 30 from $40.52 billion at the end of December 2021.

Reflecting impact of dwindling dollar earnings from crude oil due to rising fuel subsidy cost. This is reflected in the 36 per cent decline in oil revenue in February, which the Central Bank of Nigeria, CBN, attributed to value shortfall recovery for Premium Motor Spirit (petrol).

According to the CBN monthly economic report, the nation recorded zero revenue from crude oil and gas exports in January and February.

However, on a monthly basis the nation’s external reserves rose marginally by 1.7 per cent from $38.484 billion at the end of May to $39.155 billion at the end of June.

Naira depreciates

Reflecting the downward trend in the nation’s external reserves, the naira depreciated in both the I&E window and the parallel market in H1’22.

In the I&E window the naira depreciated by 2.8 per cent as the indicative exchange rate rose to N425.05 per dollar at the end of H1’22 from N413.38 per dollar at the end of December 2021.

The local currency also depreciated by 6.0 per cent in the parallel market where the exchange rate rose to N615 per dollar at the end of H1’22 from N580 per dollar at the end of December 2021.

Meanwhile, analysts have expressed concern that the downward trend in the fortunes of the naira will persist in H2’22 due to dwindling dollar inflow amidst strong demand pressure.

Expressing similar concerns, Aisha Ahmad, Deputy Governor, Financial Systems Stability Directorate of the CBN, in her personal statement at the Monetary Policy Committee, held in May, said: “Exchange rate stability remains a key concern and policy focus area for the monetary authority.

“In particular, demand management and supply stimulation strategies such as growing export proceeds and remittances as long term, sustainable sources of forex supply are critical initiatives in this regard.”

The importance of this focus is reflected in the current account balance position which recorded three consecutive quarters of surpluses in the second, third and fourth quarters of 2021, following over ten quarters of deficits.

According to her, “The surplus was driven mainly by secondary income, especially remittance flows which increased by 17.38 per cent to $5.02 billion in Q4’21 from $4.07 billion in Q1’21”.

She stated further: “Forex inflows also increased month-on-month by 16.84 per cent from $6.07 billion in February 2022 to $7.09 billion in March 2022, however, net flows decreased marginally to $2.64 billion in March 2022 from $2.90 billion in February 2022 with a marginal decline in gross external reserves by 1.71 per cent over the same period.

“Whilst Emerging Markets and Developing Economies (EMDEs) face the threat of capital flight, this risk is somewhat benign for Nigeria, given the relatively low base of Foreign Portfolio Investments, FPIs, compared with pre pandemic levels. Even so, a rise in the Monetary Policy Rate, MPR will close the yield gap and ensure Nigeria remains a competitive destination for offshore capital.

“This, coupled with ongoing export promotion policies of the Bank and other complimentary fiscal initiatives will be critical to maintain exchange rate stability and harness Nigeria’s huge economic potentials.”

Experts’ position

Analysts at FSDH Merchant Bank projected the exchange rate on the I&E window to reach N430 per dollar by the end of 2022.

In the company’s macro review and outlook for Nigeria, April 2022, they said: “While the year to date performance of Nigeria’s exchange rate on the I&E window remains on the gaining side, the recent performance suggests increasing pressure on the currency.

“The naira exchange rate at the end of Q1’22 appreciated by 4.3 per cent to N416.25/$ from N435/$ at the close of Q4’21. However, the currency depreciated to N419.5/$ as of 21, 2022 in April as a result of limited Forex supply.”

Making a similar projection, analysts at Financial Derivatives Company, FDC, said: “Naira is expected to trade within the band of N610/$ and 615/$ as demand pressure is expected to continue at the parallel market owing to forex scarcity. The supply of forex by the CBN at the IEFX window will remain constrained in the near term. The exchange rate at the I&E window is expected to hover around N419/$ and N421/$ in the near term.”