Short selling: Don’t be the ‘Dumb Money’

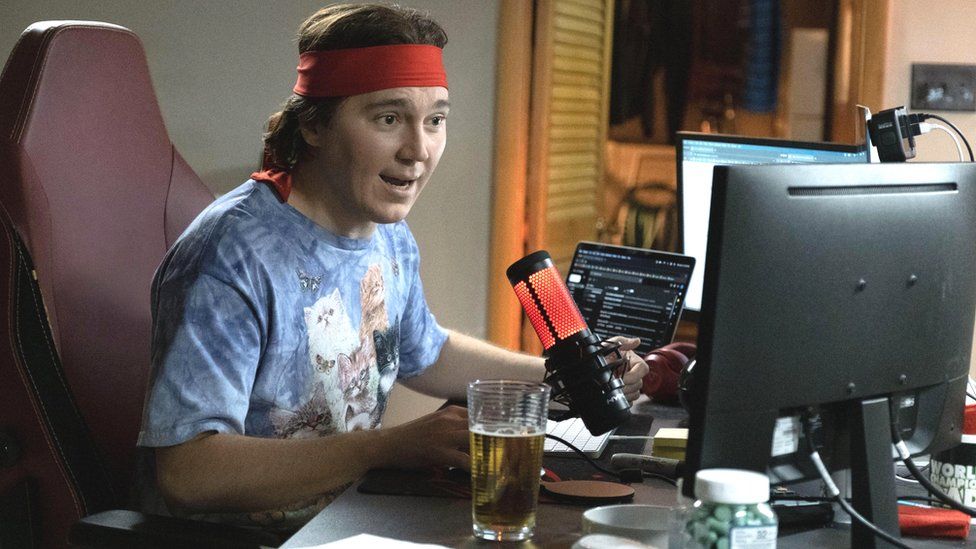

Peter Roscoe has been trading in the financial markets for 18 years.

Originally from Teesside, he started out in the finance industry, but for the past eight years trading has been a sideline to his full-time job running a shooting range in Bulgaria.

Mr Roscoe shares his experience on a YouTube channel, where he talks about his trading wins and losses.

In recent years, he has seen the rise of online trading apps bringing new financial tools to ordinary people. Tools like short selling.

Shorting a stock is the opposite of most normal trades. It’s where you borrow a stock and immediately sell it. What you’re hoping is that its value goes down. If it does, you buy it back cheaper and pocket the difference.

Defenders of short selling say it can play an important part in the markets, by helping find the true value of an asset, and sometimes rooting out fraudulent behaviour.

But it’s a very high-risk form of trading, and until recently, something that only professionals could do. However, with the emergence of online trading platforms, amateur investors can now do it in seconds.

That’s not something that Mr Roscoe necessarily recommends.

“I get messages all the time. ‘Hey, I want to try this day trading shorting thing.’ In the comment section, emails – minimum one a day. And I always say, ‘look, are you employed? Don’t do it’.”

“Unless you can commit four to five hours a day, Monday through Friday, and watch the market, just watch these tickers go up and down for six months, you’ve got no chance. And by the way, after that, there’s a good probability you’ll still fail.”

Despite such warnings many have plunged into short selling.

“The rise has been phenomenal,” says Dan Moczulski, UK managing director of E-Toro, which has seen shorting on its platform rise dramatically over the past three years.

He says the Covid pandemic played a key part. “A lot of people were working from home, and so it allowed them to look at different ways of making money.”

He also thinks the culture around money has changed in the UK since the pandemic.

“People didn’t talk about their finances – maybe it was just house prices that people would talk about at a dinner party. Now people are very happy to share their own stock portfolio, they’re happy to share their wins and their losses, which is something that just didn’t happen five years ago.”

Social media is now full of big-name short sellers and amateur traders loudly pointing out what stocks they think are destined to fall.

One kind of trader has won newfound prominence. That’s the activist short seller: a trader who doesn’t just bet against companies hoping their share price will fall, but who does so by publishing detailed research with brash headlines.

One of the most prominent is Carson Block from the firm Muddy Waters. Many times, firms like his will accuse companies of outright dishonesty, betting that their stock will fall when they outline their concerns.

“The gap in the market that we fill is to say, hey, this management has been bamboozling you investors or misleading you,” says Mr Block. “And here’s what’s really going on. And this is why we’re short. So from that perspective, what we are, as activist short sellers, are providers of transparency to the market.”

Activist short sellers are divisive. By talking down companies, some accuse them of distorting the market.

“A lot of people think that the day that we publish and something goes down a lot that we’re high fiving each other and standing on desks,” says Mr Block. “No. The more something drops on day one, the more I think ‘ok – they’re going to come after me, I haven’t heard the last of this’. So there’s really very little celebration on the days where it’s going well.”

Even for activist investors who have more support than the individual trader, it’s a stressful way to make money.

“It’s a profession that has burned most of its practitioners out within a few years, and I’ve been doing it 13 years, and it’s definitely putting miles on me,” says Mr Block.

Peter Roscoe agrees.

“If we would go on my first 100 shorts, I’d probably say I won 30% of them and lost 70%. You are going to be wrong quite a lot of times.”

Dan Moczulski from E-Toro points out that there are protections in place for amateurs attempting short selling on his company’s platform, but that the high risk is fundamental to the trade.

Shorting is done on E-Toro using something called a CFD – a contract for difference. Part of that means users must complete a suitability test.

If a trade has racked up losses more than 50% of the capital on an account, then E-Toro will start closing the position. Also, on CFDs a customer can never owe the broker more than they originally put down on the account.

“These things separate retail shorting from institutional shorting that, as you say, has unlimited risk,” Mr Moczulski says.

Investors who trade with their own money, and don’t have a history of working for banks or investment firms, are know as retail investors and sometimes, disparagingly as Dumb Money.

There’s now a movie of the same name that follows the GameStop shorting saga, and how many online amateurs got swept up in trading its stock, with many losing money.

Even for an experienced trader like Mr Roscoe, short selling only accounts for 5% of what he does – and he makes the most of any wins.

“I have rules,” he says. “If I make $1,000 (£823) from one trade on a short, we have to go out for lunch the next day for a steak dinner with the family, right? If I make 5k, I’ll go and spend $1,000 on an investment bottle of whiskey.”