‘Naira swap can’t stop terrorism’

—Advises prosecution of indicted sponsors, conniving banks

By Johnbosco Agbakwuru, Abuja

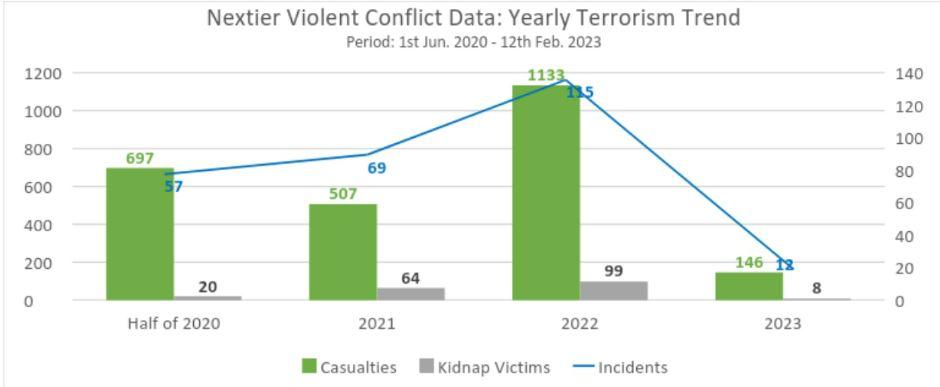

An investigative report released by public policy researchers and analysts – Nextier, Sunday said that the President Muhammadu Buhari’s decision to redesign the Naira as part of efforts to stem the tide of terrorism in Nigeria is not likely to yield desired results in the end.

The report advised the Nigerian government to have the political will to courageously and diligently prosecute already identified terrorism sponsors, including those unmasked by foreign partners like the United Arab Emirates and the United States of America.

Recall that on November 23, 2022, President Buhari and the Central Bank of Nigeria (CBN) unveiled the redesigned ₦200, ₦500 and ₦1,000 Naira notes, explaining that individuals and corporate organisations were restricted to a weekly ₦100,000 and ₦500,000 cash withdrawal limit over the counter, respectively.

The President in response to fears expressed in some quarters that the currency swap was aimed at inflicting further hardship on innocent Nigerians, President Buhari explained that the measure was aimed instead at corrupt persons and terror financiers who hoard ill-gotten cash to bankroll criminal activities and violence, and that the Naira swap would make the old notes unusable by the criminals who have stashed them.

Following the socio-economic and political upheavals that implementation of the policy has brought on average Nigerians since the February 10, 2023 deadline given by the CBN elapsed, Nextier contended that the CBN cash limitation policy cannot effectively address the phenomenon of terrorism financing in Nigeria because of some situational and contextual challenges.

According to the Nextier report released over the weekend, “the ill-timed and quick-fix policy is a wild goose chase”.

It proffered instead, that “to mitigate terrorism financing, the government has to take some bold steps, including timely arrest and prosecution of persons indicted for terrorism financing, strengthening collaboration with other countries such as UAE and US, and sanctioning complicit banks which are used to siphon money to terror groups”.

It further said, “Nigeria should stop politicising or treating indicted sponsors of terror with kid gloves. The UAE, the US and some other countries have demonstrated a willingness to support Nigeria in the war against terrorism financing by availing the country with the names of indicted sponsors.

“Thus, the onus is on Nigeria to follow up on such external intelligence. The CBN and other banking regulatory agencies and institutions should be more diligent in their watchdog roles. They should expose and sanction banks which collude with terrorist groups or their financiers appropriately in line with extant rules” the report advised.

Nextier recalled that “in March 2022, the United States placed six Nigerians on its terror list for their involvement in sponsoring terrorism after the Federal Court of Appeals in the United Arab Emirates sitting in Abu Dhabi had sentenced them for transferring $782,000 from Dubai to Boko Haram in Nigeria. Two were sentenced to life imprisonment and four to ten years for violating the UAE anti-terrorism laws.

“Other indicted Nigerians who were involved in facilitating the money to Boko Haram fighters are yet to be arrested and much more prosecuted by the government, to the disappointment of most Nigerians and supportive external governments.”

Although Nextier praised the Naira redesign and its intention, it insisted that the timing of its implementation along with other new programmes at the twilight of the Buhari administration was badly timed, costly and time consuming.

It stated: “Attempts by the Nigerian government through the CBN to limit the cash in circulation to cut off the oxygen (finance) of terror are a welcome development. However, the cash policy is fraught with challenges that hamper its effective implementation.

“It is ill-timed. The current administration seems to have just woken up from slumber by fusing so many new policies for implementation at the twilight of his administration, as evidenced by the Naira redesign and the national census currently in the works.

“These costly and time-consuming policies are being implemented in an inauspicious time of fuel scarcity and pervasive violence, making life unbearable for ordinary Nigerians. As a result, the administration has not been able to secure the needed public buy-in and support for the policies.”

Underscoring the link between finance and terrorism, Nextier concluded that “over the years, successive Nigerian governments have not been able to effectively break the collusion and ties between the banks and criminal groups such as terrorist sponsors and money launderers.

“For example, between the mid-1980s and 1999, the country lost $100 billion to money laundering activities.

“Similarly, an estimated $25 billion was lost to laundering activities between 2001 and 2004 after Nigeria returned to civil rule. Much of these illegal inflows and outflows of money through the banking systems are used to sponsor violent crimes and terrorism.

“Over the years, the government has not been able to hold the banks and those who illegally use them to account. Experts believe the CBN cash limitation policy is a wild goose chase – like others before it.

“Already, some terrorist groups have started to brandish bundles of the new Naira notes online. This shows that the policy has failed”.