New rules proposed for buy now pay later

Getty Images

Getty ImagesRules on so-called buy now pay later (BNPL) loans will be tightened up, the government says – including new guidelines on advertising and checks to ensure customers can afford to pay.

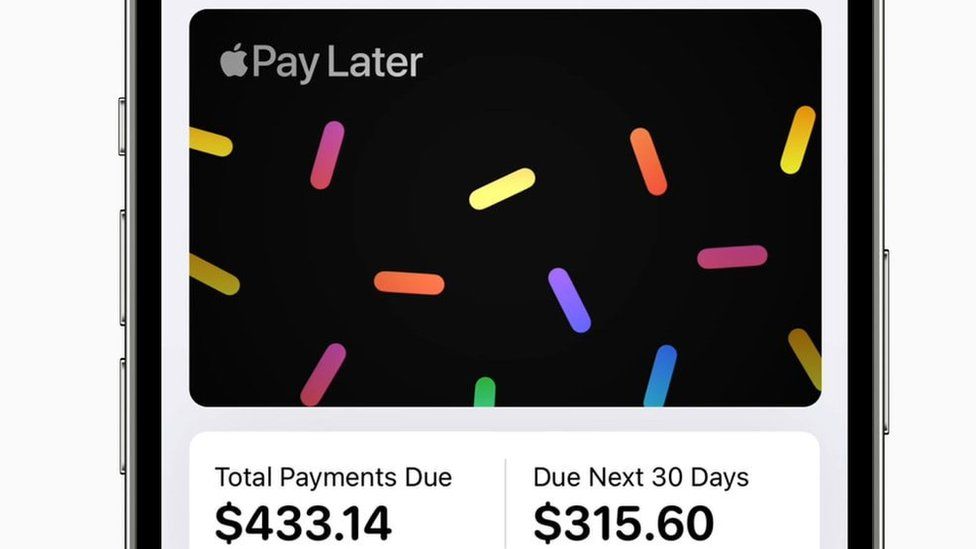

Apple has said it plans to launch a buy now pay later option for users of Apple Pay, initially in the US.

But critics say BNPL schemes encourage people to spend beyond their means.

The loans – used by 15 million people in the UK in 2021 – are typically spread over a number of payments.

Although the instalments are interest free – BNPL companies make money from the retailer, usually taking a cut from sales – there may be additional charges if customers miss payments.

The main operators offering the service in the UK are Klarna, Clearpay, Laybuy and PayPal.

In September 2020, the Financial Conduct Authority (FCA) commissioned a review of BNPL schemes, which recommended the industry should be regulated.

Credit warning

A recent survey by Citizen’s Advice suggested many consumers were using credit cards and other forms of debt to make payments.

The charity heard from 2,288 people who had used buy now pay later during the past 12 months.

It found that 52% made repayments from their current account, but 23% used a credit card, 9% used a bank overdraft and 7% borrowed from friends and family.

In March it found that that young people, people in debt and people claiming Universal Credit, were at least twice as likely to have used BNPL to cover essentials such as food and toiletries, than other groups.

Under plans set out by the government:

- Lenders will be required to carry out checks to ensure that loans are affordable for consumers,

- Advertisements must be fair, clear and not misleading.

- Lenders will need to be approved by the Financial Conduct Authority (FCA).

- Borrowers will be be able to take complaints about BNPL schemes to the Financial Ombudsman Service.

The government said other forms of short-term interest-free credit, such as those used to pay for dental work or larger items like furniture, will be required to comply with the same rules.

In a statement accompanying the proposals, Economic Secretary to the Treasury, John Glen said: “We are protecting consumers and fostering the safe growth of this innovative market in the UK.”

But the proposals will not come into force for at least a year, with legislation scheduled for mid-2023, after which the FCA will consult on new rules.

-

- 13 December 2021